Naspers

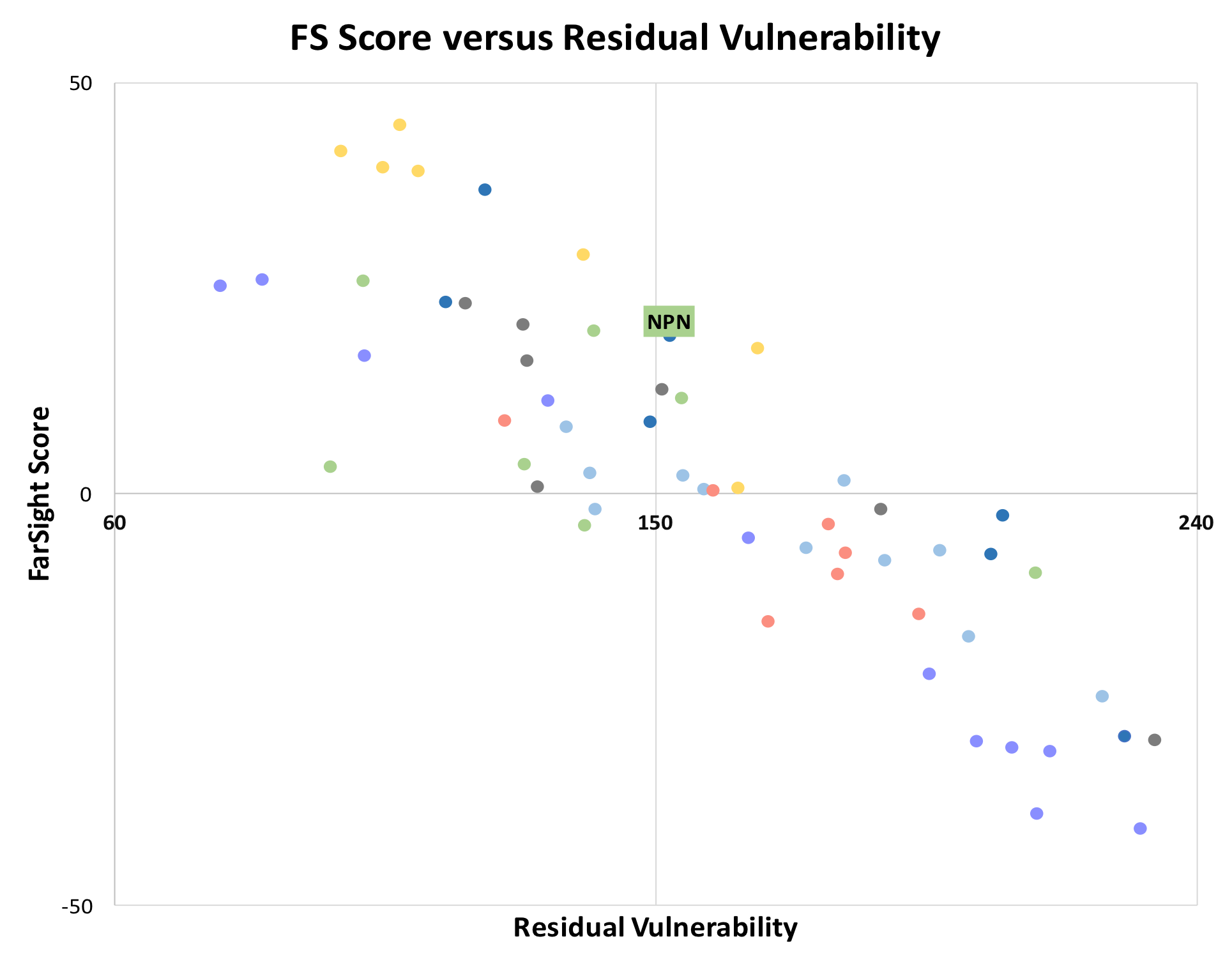

Assessment date: Oct 2017

Given the importance of leadership’s role as allocators of venture capital, governance reporting provides poor insight into the board (skills, balance, effectiveness, and quality of the leadership pipeline) and lack of transparency raises questions around minority shareholders’ interests. Chairman Bekker’s behaviour at the AGM reveals a less mature side, raising a long-term vulnerability that requires stronger counter-balance.

On the other hand, the integrated report lays out Naspers’ business model clearly, identifying drivers of value and areas of risk, and the company’s professional approach as an investor in high-tech, internet businesses. Naspers identifies “exploding data” as being central to its business as both a value driver and source of risk, and provides good context of these risks and how the company mitigates them through proactive engagement with authorities and compliance with emerging regulation (despite choosing not to disclose certain “competitively sensitive” key performance data). Reporting against the six capitals has resulted in an over-emphasis on natural capital, an area less material to long-term performance.

See the executive summary for a more complete overview of FarSight’s analysis for Naspers. Buy our full report for detailed analysis and supporting discussion.