Resilient

Assessment date: Jul 2017

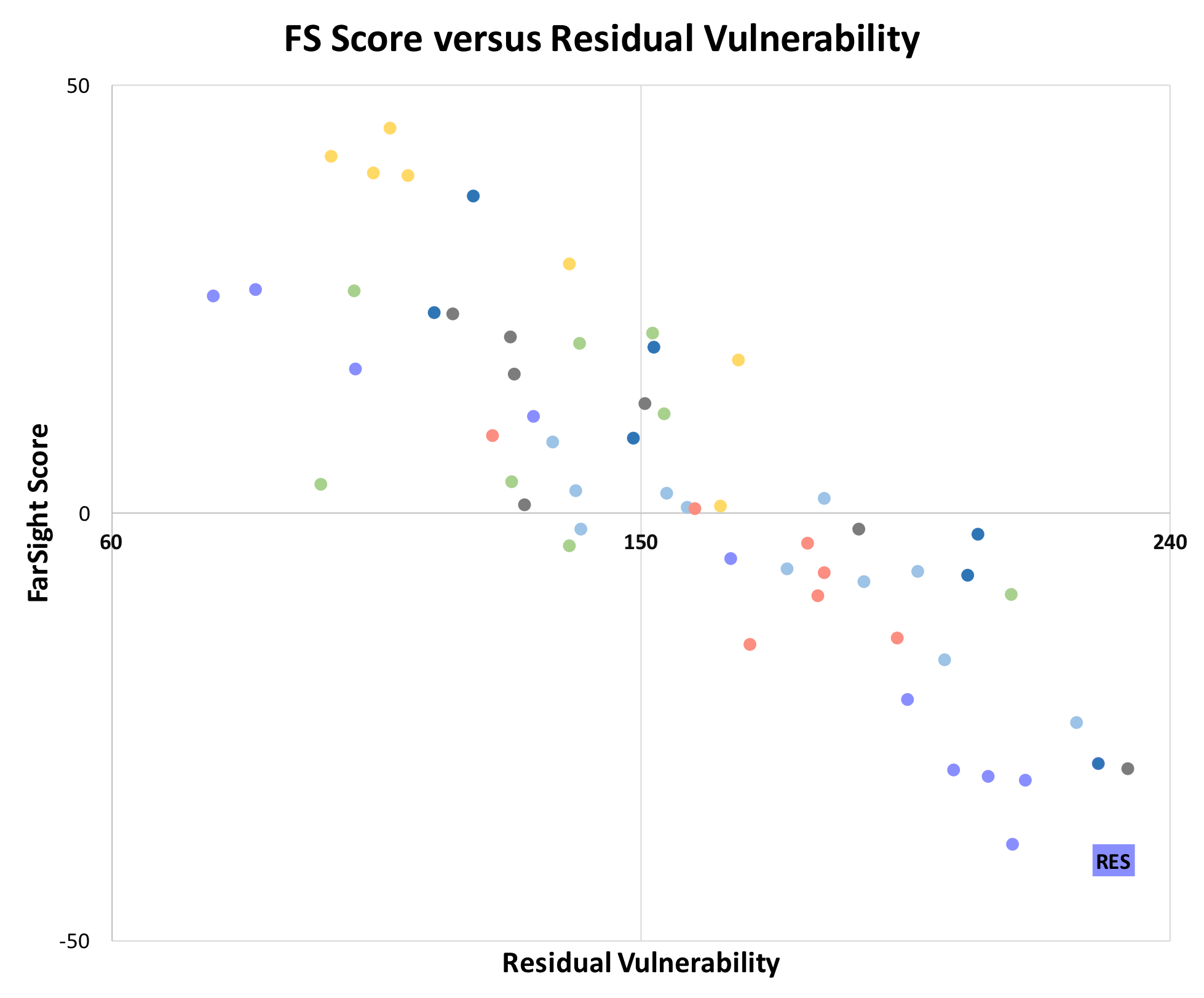

Resilient scored the worst in the group on account of its perfunctory reporting on its governance, societal and environmental obligations, especially in areas of high vulnerability, such as board balance, independence and effectiveness.

Considering its strategy to invest in dominant regional retail centres with a minimum of three anchor tenants and let predominantly to national retailers occupying in excess of 70% of the lettable area, and its high exposure to the South African market, Resilient is vulnerable to public and legislative scrutiny for potential anti-competitive behaviour against small, local and currently marginalised shop keepers. Cross-holdings and common directorships with Fortress and Nepi-Rockcastle are further areas of concern which may ultimately affect its ability to compete for capital to grow the business. Genuine engagement with affected stakeholders around these issues is recommended.

See the executive summary for a more complete overview of FarSight’s analysis for Resilient. Buy our full report for detailed analysis and supporting discussion.