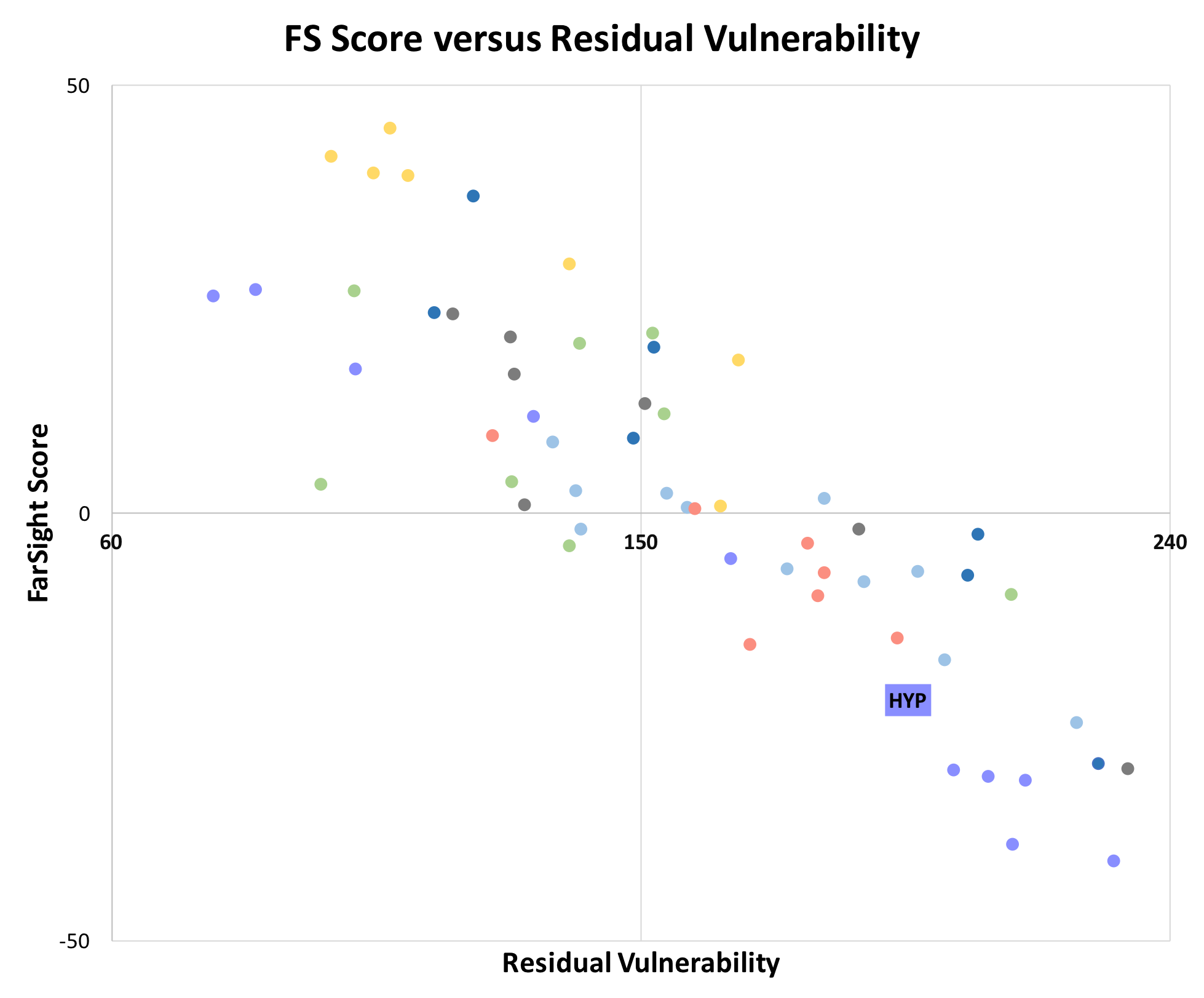

Hyprop Investments

Assessment date: Jul 2017

Hyprop has gone through the motions to produce a report within a five capitals framework, but apart from reasonable business operational reviews from the Chairman and CEO, the report degenerates into a series of paint-by-numbers tables containing little ESG information of use to the investor, aside from Edcon risk disclosure.

Ethics weakly enunciated and poorly embedded as a consistent thread underpinning the Hyprop’s business dealings. Governance reporting is of a boilerplate nature, with processes described, but little to no proactive management evidence in response to material issues, such as board effectiveness, or independence. While remuneration appears reasonably aligned to shareholder interests, exec rem disclosures cited only in notes to the AFS.

Hyprop appears to disregard societal challenges beyond basic compliance, in particular the need to offer space in malls for marginalised retailers.

See the executive summary for a more complete overview of FarSight’s analysis for Hyprop. Buy our full report for detailed analysis and supporting discussion.