Telcos, Media & Tech

Home / Reports / Materiality reports

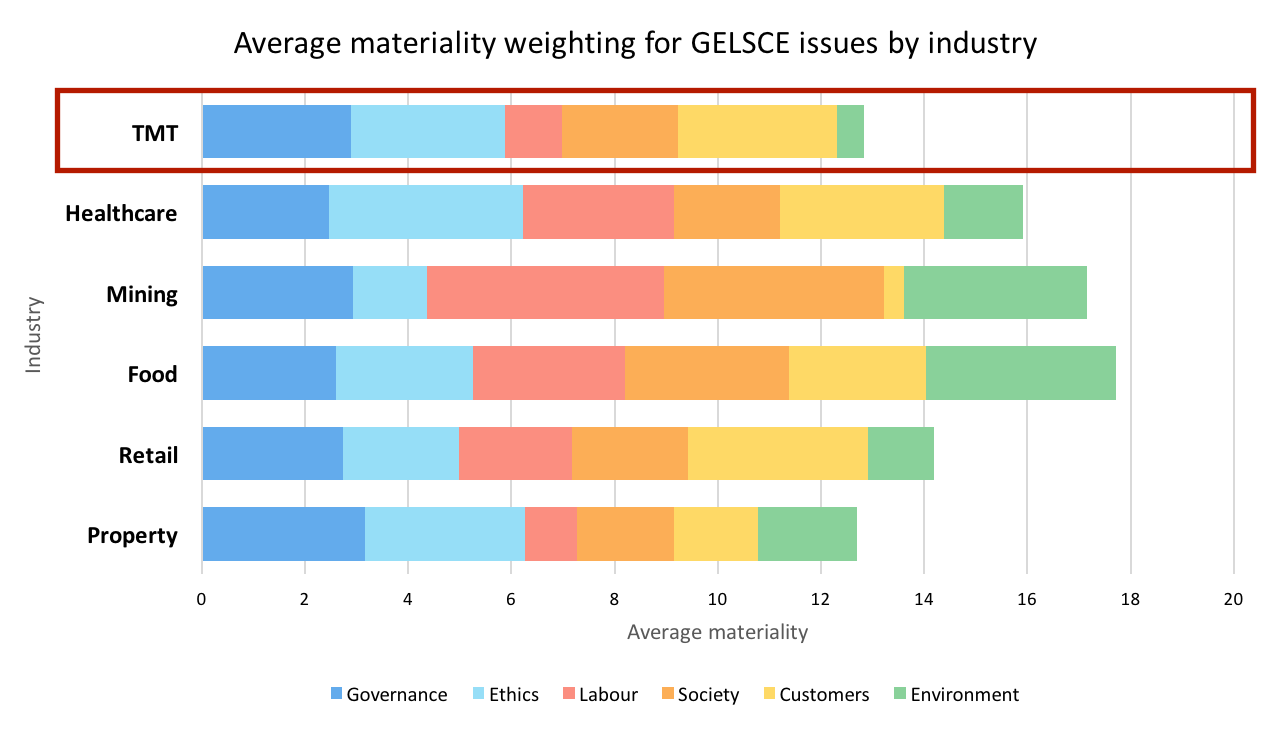

Materiality summary

The telecommunications, media and technology sectors are in a constant stage of change as new, disruptive technologies threaten the business models of yesterday. Vodacom, MTN and Telkom (the telcos) have moved through an early phase of investment in infrastructure in order to dominate ownership of networks, to a new phase where they are competing over content to serve to their customers. This trend is converging with media companies Naspers and Tencent, who likewise seek to capture customer attention, a foundation critical for monetising product and service offerings. Blue Label’s focus is specifically on distributing prepaid services to rural and poor customers. Technology firms EOH and Datatec provide the back-end services and the heavy lifting required to maintain the integrity of converging systems.

Governance

Given the dynamism of the TMT sector and the range of geographies across which companies operate (in particular MTN, Naspers and Tencent), strong boards are required, combining experience, industry knowledge and innovative thinking. Board balance and effectiveness, as well as leadership selection and preparation, are particularly critical issues where founders play dominant roles on the board, where the company has a particularly active investment and development programme (Naspers, Tencent and EOH), or where complexity has increased (e.g. Blue Label’s acquisition of Cell-C).

Ethics

Anti-competitive behaviour is a significant issue in South Africa for the TMT sector, especially for mobile telecoms operators. Whereas Ghana’s 25 million people is served by six operators, in SA, only three operators, VOD, MTN and TKG serve some 97% of the market. Other jurisdictions are taking notice, with Nigeria’s regulator classifying MTN as a ‘dominant operator’, undermining the company’s competitiveness and affecting pricing and the approval of offers.

In SA, first movers Vodacom and MTN gained significant market power in a relatively weak regulatory environment, an advantage only now being structurally addressed and potentially challenged by the recapitalisation of Cell-C by Blue Label. In June 2013, Telkom paid a R200 m admission of guilt fine to the Competition Commission for anti-competitive behaviour against Internet Service Providers (ISPs), and has agreed to transparent and indiscriminate pricing in the wholesale and retail channels.

Naspers and Tencent may be vulnerable to corruption and resultant risks of avoiding regulatory scrutiny where they operate in emerging markets. EOH has a significant share of its business directly involved in government tender work and its vulnerability has been upweighted following allegations in the media that it may have been a party to collusive practices relating to the SASSA contract (though subsequently refuted).

Customers

Network operators’ primary responsibility is to deliver dependable services and to be responsive to customer concerns. A major bottleneck hindering growth in South Africa is the lack of broadband availability. Engaging with and persuading government to allocate broadband spectrum is a major challenge for network operators. The National Integrated ICT Policy White Paper sets out how the SA government wants to provide equitable access to industry players, as well as provide wider coverage for citizens. In May 2017, a high-level agreement was reached between the Ministry and industry stakeholders, whereby the government would not take away assigned spectrum from existing licensees in return for licensees committing to participating in the Wholesale Open Access Network (WOAN), including providing access to consumers in rural areas.

In the TMT industry, the hosting of harmful content, in particular content containing sex, violence and language to children, or content that might be harmfully addictive, is an issue that primarily affects content providers and distributors, such as Tencent, as well as mobile network operators through their responsibility to manage content distributed by OTT services.

Abuse of content may take the form of censorship or alteration of content by service providers and limits on freedom of expression imposed by firms in the media industry. Fake news would be an example of content that is either frivolously or maliciously propagated across a media platform to influence the public, and at the extreme may even destabilise governments. Tencent is directly vulnerable to this issue, while NPN has some vulnerability through its interest in Tencent, with a further responsibility through other media channels it controls more directly. How companies manage government’s censorship, or intrusion is also a material issue in the TMT sector, particularly for Naspers and Tencent.

Customer satisfaction is a leading indicator of consumer purchase intentions and loyalty. Measuring and successfully responding to customer feedback in all its forms, through call centres, online portals and complaints handling, allows a network operator or media company to sense its customers’ concerns, build customer loyalty and emotional attachment to the brand. Conversely, not providing customers with fair, easy-to-understand tariffs, not preventing or managing roaming or bill shocks, and/or poor response to complaints can raise the likelihood of an incident destroying significant goodwill, or exposure for non-compliance with the Consumer Protection Act and consequent penalties.

Equitable access to products and services is a national imperative to bring about a more equitable society.

In the TMT sector, there has been increasing public outcry against high costs of data, encapsulated in the #datamustfall campaign. Not only is data up to twice as expensive in South Africa as in other African markets, extraordinarily high out-of-bundle rates and pay-as-you-go (prepaid) data vouchers are often an order of magnitude more expensive, unfairly burdening lower-income citizens. Society has yet to sanction the TMT sector for this behaviour, but more mature leadership will notice and respond to the trend towards equity being pursued by governments across Africa.

Customer ID protection and data privacy has become a a key risk as media companies gather vast stores of consumer information for advertising as well as e-commerce-related revenues. Exposure and subsequent sanction would undermine the entire business models of the likes of Naspers and Tencent, and to an increasing extent, other companies across the sector. Examples of customer data requiring protection include: records and content of communications, demographic data, behavioural data, and other personal information that can reveal or compromise the identity of an individual.

Telcos and media operators in emerging economies take on political, as well as socio-economic challenges faced by the government of the host nation. Vodacom and MTN note national security and customer SIM registration regulations in their African markets, with MTN’s poor stewardship of these regulations in its Nigerian market resulting in considerable value destruction for the company through the payment of fines. More onerous on-boarding and registration of new subscribers and SIM cards, as well as enforced disconnections pose typical risks faced by the sector.

[button link=”http://farsightfirms.com/telcos-media-and-tech/” type=”big” color=”red” newwindow=”yes”] View this Sector Report[/button]

[button link=”mailto:reports@farsightfirms.com ?subject=Telcos,%20Media%20and%20Tech%20Materiality%20Report” type=”big” color=”red” newwindow=”yes”]Buy full Materiality Report[/button]