Property

Home / Reports / Materiality reports

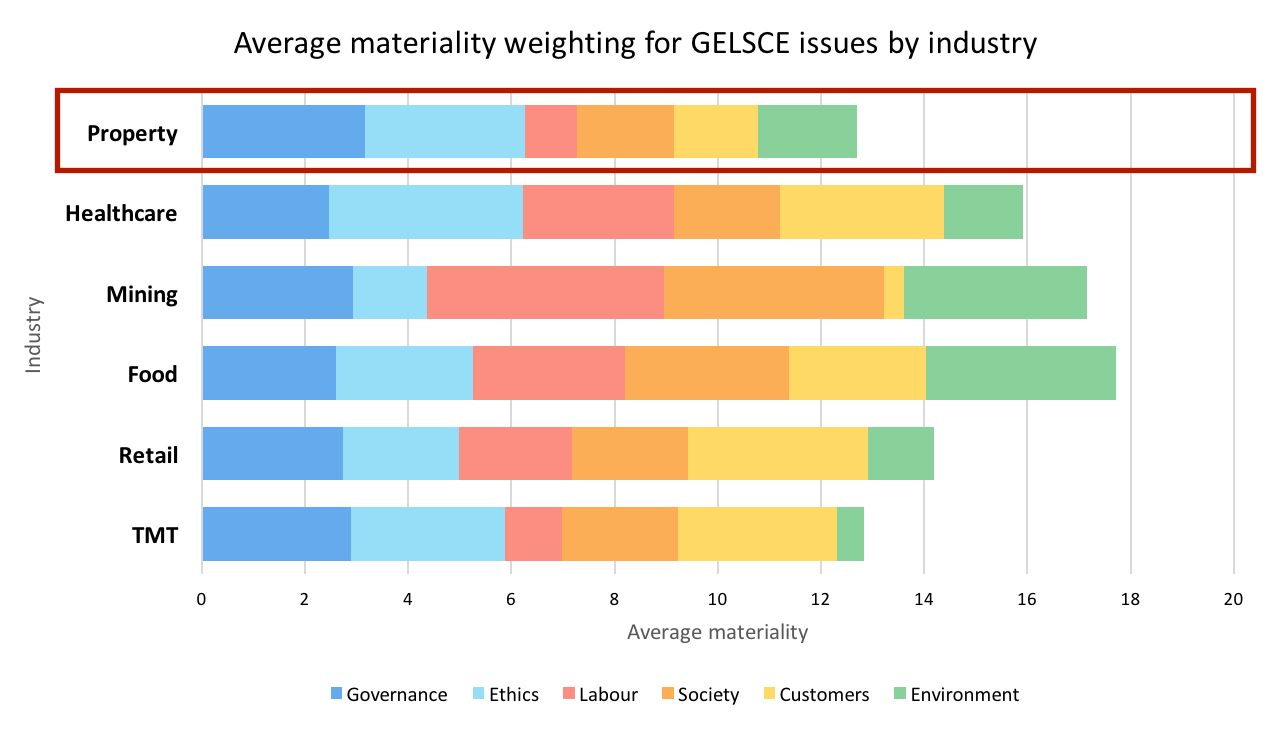

Materiality summary

The property sector has enjoyed a boom over the last decade in South Africa, but given the maturity of the SA market and political uncertainties, local investors have been growing their offshore portfolios, particularly Eastern Europe. Governance and ethics have recently become key issues for the property sector as legislation and government scrutiny in emerging markets (both in Africa and in Eastern Europe) raise the risk of exposure for companies flouting regulation and ethics in their business dealings. Companies in SA have additional societal burden relating to pressure from government to improve Black Economic Empowerment

Governance

Responsible decisions require a strong board, combining experience, industry knowledge and innovative thinking, encapsulated in the governance issues: board balance and effectiveness, as well as leadership selection and preparation. Companies weighted highest for this issue will be those demanding a broader set of skills, e.g. raising funding, identifying and delivering on acquisitive growth, managing project delivery, tenant relations, etc. This demand is associated with those that have a more active investment and development programme, or have taken on more complexity, such as operating across multiple geographies and subsectors (retail, office, warehousing, etc.).

Independence on the board requires aligning the interests of leadership with the interests of minority shareholders. Where directors serve on multiple boards, or have significant holdings in other companies, some disclosure and discussion is expected in the integrated report.

Given the opportunities for executives in the property sector to enrich themselves at the expense of providers of capital, FarSight has given significant weight to remuneration & incentives and audit independence (though the FS weighting reduced as the protocols around audit are tightly legislated and controlled). Companies listed on the LSE are encouraged to take up a significant shareholding in the company (>400% of annual pay) in order to incentivise alignment with shareholders.

Ethics

In the property sector, businesses deal with brokers and tenants in the establishment and management of leases. They deal with banks and other finance partners for financing, with municipalities for approvals of development plans, and with contractors for building and maintenance. A general set of values that guides and defines the way the company conducts its business can have a significant impact on the company’s sustainability. Trusted REITs will be preferred, while those in less in control of moral DNA might lose goodwill, or fall foul of legislation.

Theft, fraud and corruption has historically attracted little societal attention, but is raised as a vulnerability considering the undoubted temptation to seek advantage in the development marketplace, as well as the potential opportunities to commit fraud in the governance of funds. Given the increasing incidence of corruption in South Africa and the public outrage against corporates found to have colluded with public officials and SOEs, the issue is further upweighted for the SA market.

Anti-competitive behaviour has become a significant issue in South Africa with the Competition Commission’s Grocery Retail Market Inquiry, currently under way. Amongst its objectives is to inquire into the impact of long-term exclusive lease agreements and the role of financiers on competition in the grocery retail sector. Mall owners in regional centres that enjoy market power are more vulnerable to this issue, as well as where individuals or companies have cross-holdings, both between property companies, as well as with large retailers.

Customers

Despite its business importance, product suitability issue enjoys limited societal scrutiny. Issues of concern include building health impact on occupants, quality standards, cleanliness, convenience of access (parking) etc. Treatment of customers refers to customer satisfaction and the response by building owners to complaints by tenants and is weighted slightly above average for materiality. Access to products and services is weighted and low and customer ID protection and data privacy is a non-issue for this sector.

Environment

The trend towards green building has gained considerable traction and most high-grade buildings now differentiate their offering based on one of the Green Building standards. Building ‘green’ has become a differentiator for quality – more environmentally friendly, and more ‘natural’ – and thus more healthy and attractive for occupants and visitors. Modern companies hiring smart, young knowledge workers, or shopping malls looking to attract such shoppers, seek to create inspiring, attractive, healthy and, above all, ‘environmentally green’ buildings that uplift the visitor’s/occupant’s experience.

Energy and water conservation rank high in public perception, though companies are more concerned with reliability of supply and minimisation of cost, rather than for environmental ends. Aspects relating to energy conservation include increased efficiency of HVAC (air-conditioning) systems and onsite generation of energy, or the purchasing of renewable energy to register credits (in the UK). Biophysical impacts relate to waste management and embodied carbon and GHG emissions. Materials and resources is weighted low and external environmental risks is barely noted as a risk, rather a hygiene factor to be taken into account at design, or due diligence stage.

Society

Community impact, relates to compliance with zoning laws and adherence to the building and landscaping regulations, as well as the potential impact on the local community during development operations and construction. External societal risks relate to the general deterioration in national governance (South Africa), ineptitude and inefficiency at local municipalities responsible for processing planning applications, incorrect billing for utilities and municipal services, and possible corruption of pubic officials. A lack of adequate infrastructure and services, such as a reliable supply of electricity, are further inhibitors to growth for property companies in South Africa, as well as on the continent. Concerns for security and terrorism were raised as strategic risks by all companies in the survey operating in the UK, Western Europe and Africa.

Internal equity and industry equity are largely of concern to South African companies only, with the current The Property Sector Charter Report calling for the industry to address the challenges to transformation, in particular through the commitment to sell 35% of property disposals to B-BBEE enterprises over a five-year period, and to commit to 10% of new property development in under-resourced areas over a five-year period.

Labour

Labour issues are not particularly significant societal issues in the property sector, given the high average skill level of employees in the industry and the generally small staff to income ratio.