Retail

Home / Reports / Materiality reports

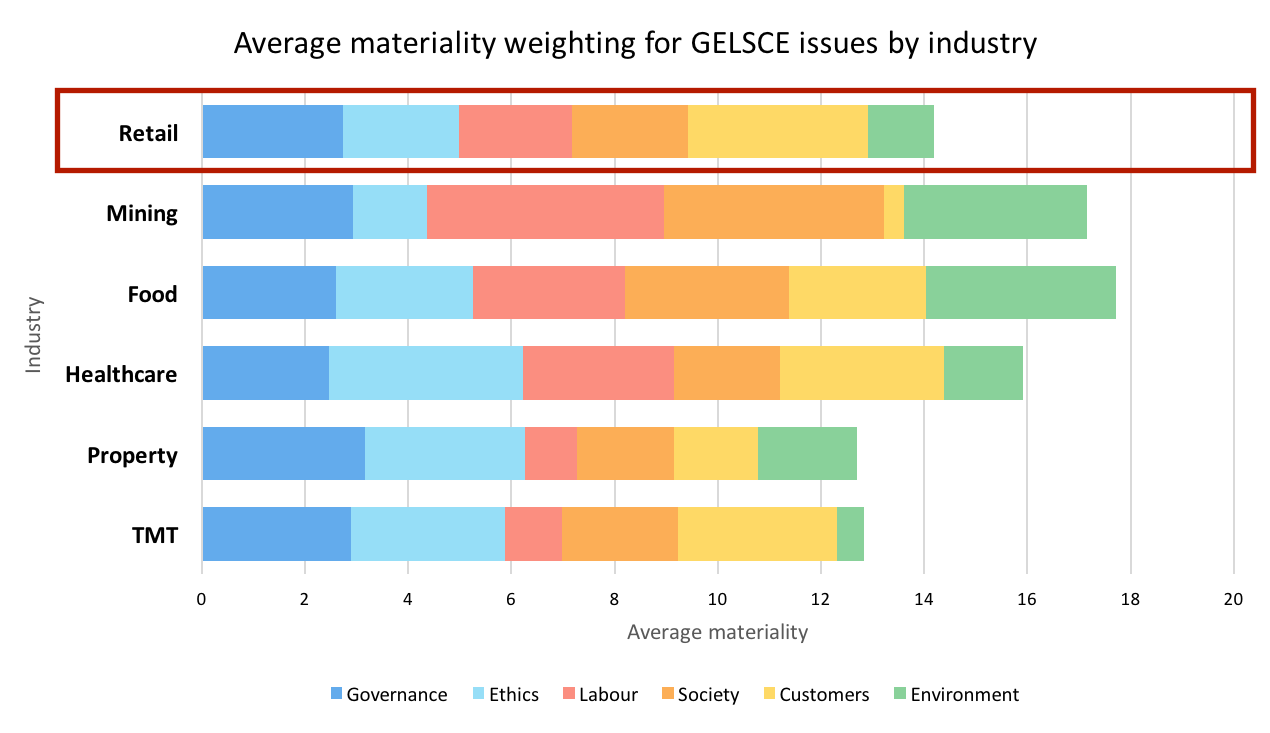

Materiality summary

Customers

In the retail sector, the most important non-financial issues relate to customers.

Product suitability

The health impact of products is an issue with significant societal consequences, as well as risk to retailers caught with brands and brand positioning that is behind the trend towards healthier alternatives. Retailers that pick up on health concerns when they first emerge, such as foods that may be carcinogenic, or lead to obesity, and find innovative strategies to position their brand as being responsible, build valuable relational capital.

Credit affordability

Credit retailers (in the same way as banks and insurers) have the further responsibility to determine whether their customers can afford the credit being offered and that their customers understand and can manage the financial responsibility they are taking on when buying on credit. Edcon had signed up more than 2m credit customers at the time of its deal with Bain in 2007 and this contributed significantly to its financial weakness in the 2008 credit crunch. In general, retailers that extend significant credit, particularly to low LSM customers, will also be more vulnerable to societal, as well as financial, risk.

Treatment of customers

Customer satisfaction is a leading indicator of consumer purchase intentions and loyalty. Measuring and successfully responding to customer feedback in all its forms, from loyalty programmes to customer complaints, allows a retailer to sense its customers’ concerns, build customer loyalty and emotional attachment to the brand. Conversely, poor response can raise the likelihood of an incident destroying significant goodwill.

Ethical advertising and product labelling, especially in the food retail industry, is an issue that, if mismanaged (for example through inappropriate targeting of children, or misleading product information), can significantly increase a retailer’s reputational vulnerability when consumer watch organisations uncover such practices.

Responsible credit and lending practices is a societal obligation to ensure customers are treated fairly when extending credit, including not charging unfair or exorbitant interest rates and other ‘add on’ fees, such as Edcon’s club membership fees (2017). In 2016, Lewis Stores was exposed for mismanagement of its credit practices at point of sale. In general, retailers that extend significant credit, particularly to low LSM customers, will also be more vulnerable to societal, as well as financial, risk.

Access to products and services

Equitable access to products and services is a national imperative to bring about a more equitable society. While some retailers may be more focussed on higher LSM categories, and thus arguably less exposed, the government and the press tend to hold food retailers responsible for providing affordable food and preventing the starvation of the poor. How companies respond to the challenge impacts on the value of their societal capital. SHP and MSM are most exposed considering their LSM positioning.

Consumer ID and data privacy

Consumer protection and ID privacy is emerging as a material issue for those retailers who gather information about their customers, particularly at the point of sale. This information can be used legitimately for digital marketing, but also brings with it the obligation to manage the information responsibly, not violating customer privacy. Credit retailers and companies with loyalty programmes are more vulnerable.

Governance

Board balance and effectiveness is a strong value driver for companies taking on significant risks, such as new acquisitions, new markets, new business arenas and companies with additional premium on institutional memory (where a key executive has retired, for example). SNH is most exposed, followed by DCP, SHP and WHL. IT Governance is crucial to support strategies to respond to online retail competition (clothing and general), as well as for food retailers with sophisticated logistics and supply chains that need to preserve the cold chain for fresh products. Acquisitive companies, such as SNH, need to streamline IT governance in newly acquired businesses and across operations. This is further exacerbated for large and complex businesses with operations in several geographies. Other material issues include Remuneration and incentives, leadership selection and preparation, and audit independence.

Society

External societal risks include destabilised political environment in South Africa, as well as the emergence of populism globally (particularly in Europe). Bureaucratic red tape and corruption adds friction to doing business in Africa, exacerbated by inadequate and unreliable infrastructure. Emergence of national global inequality impacts on retailers operating in middle market (see treatment under ‘Access to products and services’). While most retailers are affected, SHP has raised vulnerability. Industry equity relates to how large retailers treat their small suppliers. In emerging economies, especially South Africa, retailers have the further responsibility to promote local industries in the supply chain, sourcing local rather than importing from other countries. This issue is also gaining prominence globally, as an increasingly nationalistic agenda drives trade policy.

Labour

Fair treatment of labour both within the business and throughout the supply chain is an issue retailers may be vulnerable to, particularly those with the most economic power and brand exposure, selling high-volume, low margin products for which SNH, SHP and MSM are most exposed. Clothing retailers (especially those with brands) also exposed to treatment of labour in the supply chain (WHL, MRP, TRU and TFG).

Ethics

Moral DNA relates to the quality of the company’s values and how well the company lives by them in dealing with its stakeholders. Fast-growing businesses in diverse geographies retailing food and drugs have the highest vulnerability to this issue. WHL stands out with the highest materiality considering its Good Business Journey brand positioning. Anti-competitive behaviour is of some concern for large retailers considering current scrutiny from the Competition Commission.

Environment

Most of the environmental impact for retailers lies in the supply chain, with some minor impact on the business through reliability and efficiency of resource use (energy and water). Containment of pollution and management of waste by producers supplying product to retailers (biophysical impacts), as well as responsible disposal/recycling of packaging, may be of concern where end customers are particularly conscious and prepared to vote with their dollars. WHL, considering its Good Business Food Journey, has the highest exposure to this issue.

[button link=”http://farsightfirms.com/retail/” type=”big” color=”red” newwindow=”yes”] View this Sector Report[/button]

[button link=”mailto:reports@farsightfirms.com ?subject=Retail%20Materiality%20Report” type=”big” color=”red” newwindow=”yes”]Buy full Materiality Report[/button]