Healthcare

Home / Reports / Materiality reports

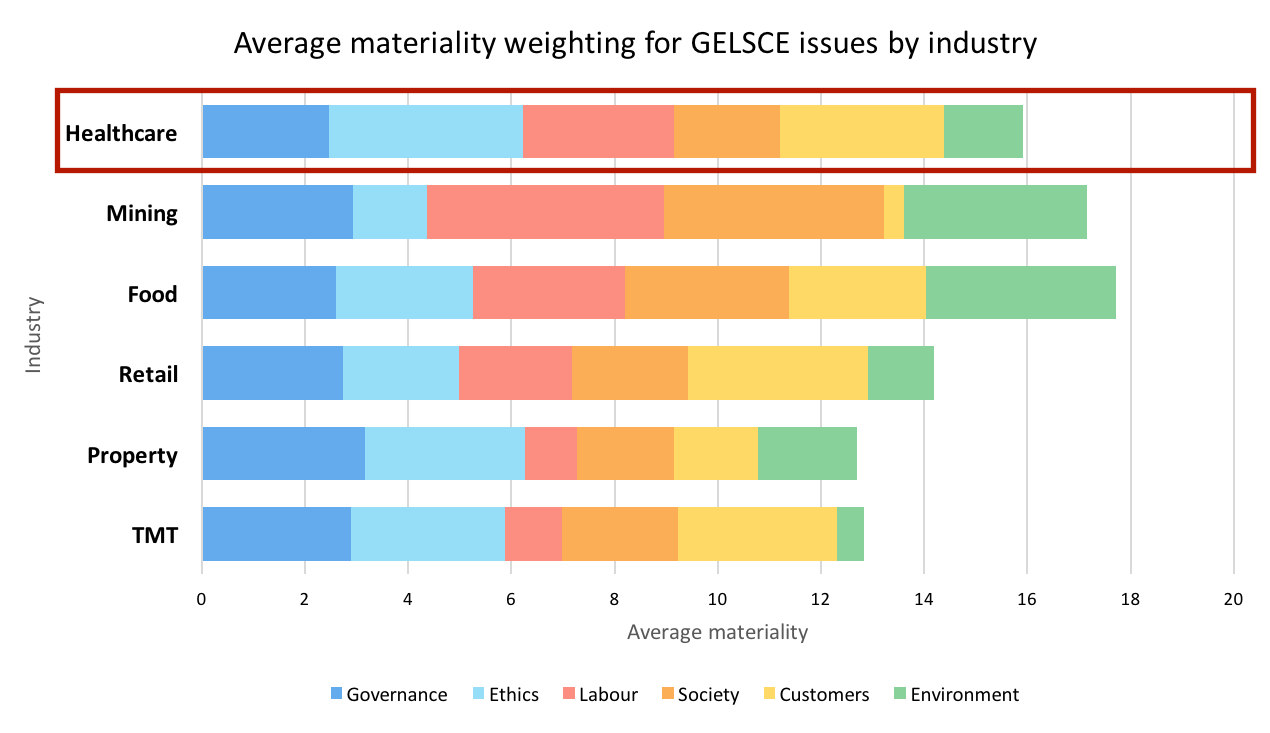

Materiality summary

Governance

Despite the economic downturn, the healthcare sector is relatively resilient, as customers need health and wellness products regardless of the state of the economy.

As a result of the sharp rise in the burden of disease, in particular metabolic diseases, cardio-vascular diseases, mental disorders and Type II Diabetes, coupled with an ageing profile and steadily decreasing number of medically insured lives, fewer healthy individuals are available to fund the overall healthcare burden.

This has resulted in an uneasy tension between governments, funders and the providers of healthcare, both hospitals and pharmaceutical companies. Governments demand lower cost and solutions that prevent rather than only treat, while funders use their increasing market power to dictate the pricing and terms of the healthcare being provided.

Other regulatory risks facing the healthcare industry include:

- The Healthcare Market Enquiry (HMI) in South Africa, as part of the government’s transformational agenda of making healthcare more affordable to the South African public (conclusion expected in November 2017);

- The National Health Insurance (NHI) White Paper introducing the possibility of contracting affordable healthcare to the private sector;

- Protection of Personal Information Act (POPI);

- Annual adjudication by the SA government of the single exit price which fails to cover the cost of increases faced by the pharmaceutical industry;

- Lengthy product registration timelines affect returns on R&D investment for pharmaceutical companies.

- Uncertainty around issuing of new bed licences by government health departments.

- Limit on the direct employment of doctors in a clinical practice role in South Africa, as per the Ethical Rules of the Health Professions Council of South Africa (HPCSA).

Customers

Multi-drug resistance and infection is an escalating threat in the hospital industry, potentially even risking pandemics. Good governance structures are required to ensure a sterile environment and responsible stewardship of antibiotic use.

Patient’s satisfaction with their experience while in the care of the hospital and its staff includes ensuring the patient is informed with respect to medical procedures and pharmaceutical information, quality of the food, reduction of noise and pre- and post-operative counselling. Response to concerns and complaints is also critical.

Pharmaceutical brand reputation depends on the responsible manufacture and supply of products, thus raising the risk exposure in the pharmaceutical industry. Highly technical demands on R&D and risk of events can result in batch rejection or product recall.

Inflated claims about the efficacy of drugs, or underplaying side-effects, can have serious consequences for both patients and for the pharmaceutical business in terms of sanctions and reputational damage. Regulation and consequent risk may vary between more and less developed markets.

There is a strong expectation from society that private hospitals should play a role in extending healthcare access to the poor and marginalised. In South Africa, the model for participating in the government’s ambitions to provide National Health Insurance is far from certain. Nonetheless, considering higher patient volumes at the lower end of the market, hospitals need to explore new healthcare models, such as are being pioneered by the likes of Lenmed, BusaMed and Phelang Bonolo.

Governments are scrutinising the pricing of pharmaceuticals and implementing programmes to control and/or reduce the pricing of pharmaceuticals, including price regulation of pharmaceutical products and promoting increased usage of generics.

Ethics

Hospitals are offering higher quality of care, but at higher cost, resulting in the Competition Commission’s Health Market Inquiry (HMI) into the private healthcare sector. Amongst the issues relating to hospitals are incentive-based arrangements between hospitals and doctors that may bias treatment in favour of excessive hospital utilisation. This also applies to other services, such as emergency transport, pathology, radiology and anaesthetists.

Corrupt practices are a significant vulnerability facing the hospital sector. Specialists with conflicted interests may prescribe unnecessary procedures. If ethical codes aren’t enforced as part of the company’s moral DNA, violations, such as in the case of the illegal kidney transplants in 2001 and 2003 may occur, seriously compromising basic human rights. More pervasive practices include the inflation of consumables and expenses through devious billing practices, and a lack of transparency in accessing information, such as for pricing and billing.

Labour

There is intense competition for skilled doctors in the hospital sector. Key to attracting doctors is the quality of the resident nursing care, the efficacy of governance structures, professional networks to provide for continuous professional development, as well as forums that help with issues such as antibiotic stewardship and optimum levels of care. Nurses, intensive care unit (ICU) employees and semi-skilled labour, are also in high demand. Likewise, specialist technical skills are a key resource for competitive advantage in the pharmaceutical industry.

Society

South Africa is the main territory affected by legislation demanding levels of local equity in order to compete for government tenders. This affects hospital group LHC for bed allocations and pharmaceutical group AIP which supplies medicines to the Dept. of Health’s programmes. All companies operating in SA are affected by this societal imperative. Equity aspects include: ownership, employment and preferential procurement from local suppliers.

Environment

Environmental issues were not identified as being critical to the business, though a number of aspects contribute to business sustainability. Reliable supply of utilities, such as electricity and water impact on both hospitals and pharmaceutical sectors’ business continuity, while hazardous waste and spills from manufacturing sites are specific risks for the pharmaceutical sector.

[button link=”http://farsightfirms.com/healthcare/” type=”big” color=”red” newwindow=”yes”] View this Sector Report[/button]

[button link=”mailto:reports@farsightfirms.com ?subject=Healthcare%20Materiality%20Report” type=”big” color=”red” newwindow=”yes”]Buy full Materiality Report[/button]