Food producers and brands

Home / Reports / Materiality reports

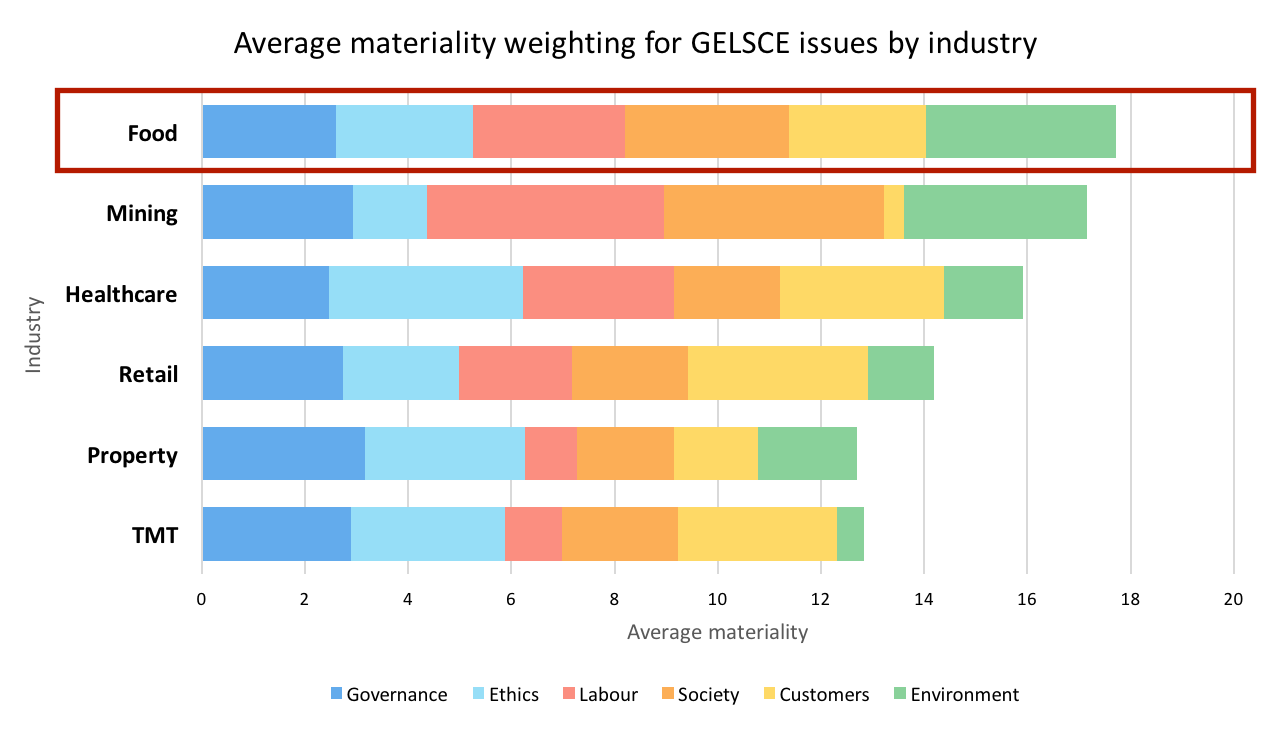

Materiality summary

Considering the reliance and impact on natural resources for companies working in the primary sector, it is not surprising that environmental issues dominate the most significant material issues for the food sector. Of similarly high materiality for the food industry are the customer facing issues of product representation & suitability, and access to food.

Environment

The fishing industry exploits natural resources in the sea, where the only way to renew the resource is through conservation measures and control through the application of quotas. Further, the industry is exposed to illegal fishing, which erodes yields, particularly in the context of already fully- or over-exploited stocks. Sugar cane farms require the extensive use of land with competing demands for its usage. Further, the land itself is vulnerable to mismanagement and can suffer from erosion and general loss of its natural resource value. Food companies have inputs to their production processes which may be affected by climate and weather events (e.g. tomato blight).

The cost of energy, the reliability of the energy provider, green-house gas emissions from agricultural and food processing activities, and the management of the product’s carbon footprint all contribute to the energy usage and carbon footprint of the companies.

The responsible usage of water in the food processing industry is a hot topic in the eye of the public. In particular, the amount of water consumed to produce a litre or a kg of end product for the consumer is fast becoming a performance measure under scrutiny. Further, access to quality water as an ingredient of the end product is a strategically important issue for producers reliant on traditional water sources that may be now under pressures from encroachment.

For companies that procure agricultural products as inputs to their processing plants, they have an obligation to understand and manage the environmental management practices of the primary producers, typically, the farms and fisheries concerned. The food processing industry is notorious for producing significant waste from products that don’t meet quality standards, or are wasted as a result of spoilage in the supply chain. Processing of agricultural products also results in significant contamination of water courses from the discharge of effluents (potentially impacting on downstream communities), and these impacts are falling under increased scrutiny from authorities as well as the public.

Customers

Following the Consumer Protection Act of SA, consumers have the right to demand full disclosure of the price of goods and services, as well as protection against false, misleading or deceptive representations. In the context of the food industry, there are a number of issues here:

- Marketing and ethical advertising – the industry is vulnerable to deceptive or unfair marketing and advertising, making untruthful claims or making misleading representations in order to sway customer purchasing decisions, building brand loyalty to children based on encouraging the development of negative self-images and marketing products with a high sugar, salt or fat content to uninformed customers.

- Disclosure and labelling – How accurate and truthful is the disclosure of harmful product ingredients on the labelling of products, as well as other pertinent information, such as product net weight, inclusion of bulking ingredients, quality, etc.

- Nutritive value and health impact – To what extent do companies in the food processing industry seek to improve the health impact of their products and services, either remediating harmful impacts (such as of obesity from sugar content, or from harmful chemicals used in their production), or developing and promoting realistically beneficial impacts. This is particularly relevant to companies in SA where rapidly rising rates of obesity foreshadow increased pressure on the public health system.

The issue of food security for the poor and equitable access to nutritious foods for South Africa’s low-income population is one of the most significant ESG issues facing the food processing industry. Regulators, as well as society in general, will continually seek to balance the ability of food producers to survive and thrive with the imperative to feed populations. This is exacerbated in times of economic stress where the flexibility of producers and consumers is constrained.

Labour

Rhodes Fruit group is judged to have the highest exposure to human rights vulnerabilities as a result of their farm holdings where workers have little or no ownership stake and are vulnerable in terms of security of tenure, income and lack of bargaining power for fair treatment. Tongaat, although also with agricultural holdings, has less vulnerability as many previously disadvantaged sugarcane farmers own their own farms. However, this is not the case in other countries where they operate.

Society

The promotion of subsistence fishing and farming, as well as the development of small-scale farming and fishing businesses is an intense political issue being driven by various different constituencies in SA and consequently by national government as it tries to balance the demands of economic growth and equitable distribution of the factors of production. This affects companies at the primary end of the production chain, including OCE, RCL, TON and TBS. Companies with a large local procurement spend are under more pressure from the dti’s BEE Codes to promote local enterprise and supplier development. These would include AVI, RCL and PFG. Those that own a larger proportion of their upstream supply chain are less exposed to the issue, such as OCE and RFG.

Food processing companies that employ farm workers (or fishermen) in their supply chains will be increasingly scrutinised for the fair labour practices and the human rights practices of companies not under their direct control. Society increasingly associates fair practices down the supply chain with the brands that reach the stores, and these companies need therefore to ensure that the association being made with the brand is not tainted by human rights abuses or questionable practices taking place along the supply chain. Oceana (and also by part ownership, Tiger Brands) have exposure to the fishing communities where they are the dominant employer. This includes Houtbay, Laaiplek and Sadhana Bay. Tongaat has significant exposure to communities affected by its farming operations, as well as by its intended development of its property division. Rhodes is also fairly significantly invested in the Drakenstein farming community, with a significant community impact.

Ethics

Anti-competitive behaviour

Collusion is a particular vulnerability for companies in the food processing industry, and the spotlight is never far removed from this sector. Pioneer Foods and Tiger Brands were involved in a scandal in the early 2000s that involved the fixing of bread prices. At the time, the companies involved paid their fines and moved on without significant damage to their brands, largely because there were no other competitors that could profit from their loss of consumer confidence.

[button link=”http://farsightfirms.com/food-producers-and-brands/” type=”big” color=”red” newwindow=”yes”] View this Sector Report[/button]

[button link=”mailto:reports@farsightfirms.com ?subject=Food%20producers%20and%20brands%20Materiality%20Report” type=”big” color=”red” newwindow=”yes”]Buy full Materiality Report[/button]