Industrials

Home / Reports / Sector Reports

Materiality summary

There are no critically material GELSCE issues specific to the industrial sector. Rather, companies in this industry are challenged by competition in their markets and by their own ambitions to achieve growth, for example expansion into Africa, or through corporate action.

The following issues populate the top half of the materiality table:

- Treatment of customers and product suitability in the automotive subsection

- Anti-competitive behaviour for companies dominant in their regions, or that have cornered a product niche

- Transformational issues (internal and industry equity) for companies exposed to the South African market

- Fair labour issues, both within companies and related to their supply chains, with safety risks raised at AFE

- Audit independence, an issue attracting scrutiny following recent corporate failures

Results

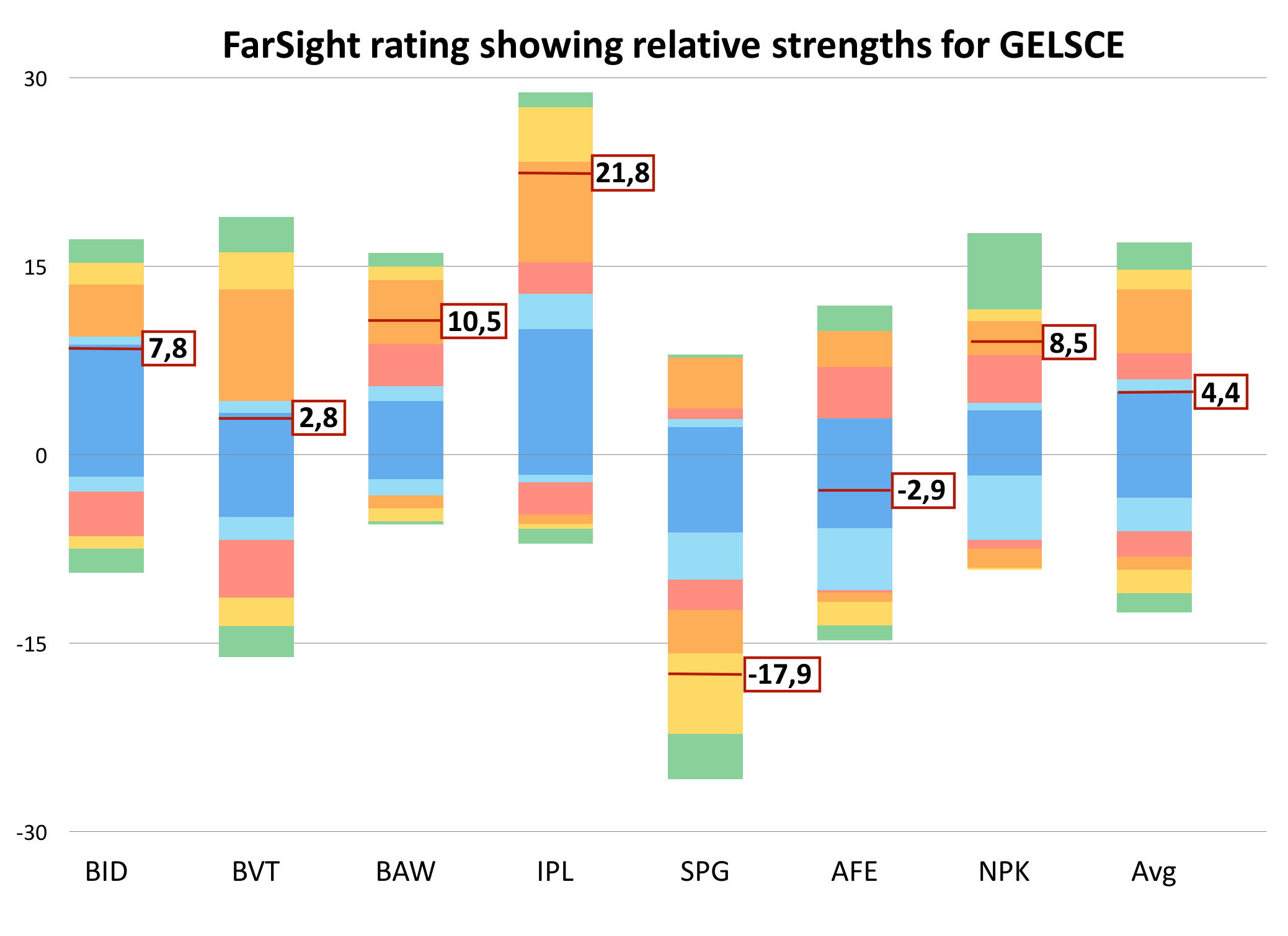

Aside from outliers Imperial and Supergroup, industrial companies tend to adopt a basic compliance attitude to material stakeholder issues. None of the companies in this peer group disclosed high-quality KPIs, nor used these effectively to draw insight and derive strategic responses linked to the issues.

Imperial the best performer, despite omitting some significant HR indicators. Supergroup by far the worst amongst peers, despite impressive business turnaround. Its confidence in business growth now possibly distracted from long-term value drivers identified within the GELSCE areas.

Bidcorp outperformed Bidvest for maturity of leadership largely through better/more mature governance reporting, though the latter responds proactively to societal demands for internal and industry equity).

Barloworld produced a formulaically structured report that fails to provide sufficient exposure for relevant issues. Solid and consistent reporting of values underpin a better than average score for leadership maturity.

AECI generally compliant, but so bureaucratically formulaic that doubts are raised as to leadership’s focus on material issues.

Nampak shows good response to material issues, but let down by bland tabular reporting and a poor link between stakeholder relationships and how the company actually engages with its stakeholders.

See the executive summary for individual company scores and materiality weightings. Buy our full report for detailed analysis and substantiation of our analysis.

[button link=”mailto:reports@farsightfirms.com ?subject=Industrials%20Report” type=”big” color=”red” newwindow=”yes”]Buy the full report[/button]