How FarSight works

We arrive at this score by assessing the company’s response to Governance, Ethics, Labour, Societal, Customer and Environmental (GELSCE) issues in its annual reports, on its website, through corporate announcements and interviews with business journalists.

The model has four steps: identify issues material to the business; weight these for their relative materiality; rate the company’s response to each issue; calculate the FarSight Score.

Step One: Identify issues material to the business

FarSight researchers scour national media and trade journals, CEO interviews with business journalists, regulatory reports (eg: industry ombud reports and Competition Commission reports), company Integrated Reports and SENS announcements to understand the industry, its drivers of value, its risks and vulnerabilities. These are then sorted into the 24 issue categories in our universe of issues.

Step Two: Weight issues for their relative materiality

FarSight assigns a weighting of between 0 and 30 to each of the 24 issues. Issues weighted between 0 and 5 are barely material, while issues over 25 are crucial to the business’ long-term survival.

Weighting issues is not an exact science. In the US, the Sustainability Accounting Standards Board (SASB) starts by interrogating SEC 10k (and other) filings for frequency of key words (thus starting with companies’ self-reporting bias). They then modify the resultant weighting by evaluating whether management or mismanagement of the issue will affect traditional corporate valuation parameters (e.g. profit). Finally, using discretion, they adjust upwards the weighting of issues they judge to be newly emerging. Representation on the workgroups that determine the final weightings is skewed against business and governance, and towards environmental and human rights issues.

FarSight adopts a similar three-step approach to SASB, but applies an approach more similar to the International Integrated Reporting Council (IIRC) in order to derive issue weightings. For FarSight, the weighting of an issue is affected by:

– The probability and magnitude of its impact

– On the the firm’s relationships and resources, and

– How this may affect returns to shareholders

– Through a three- to five-year window

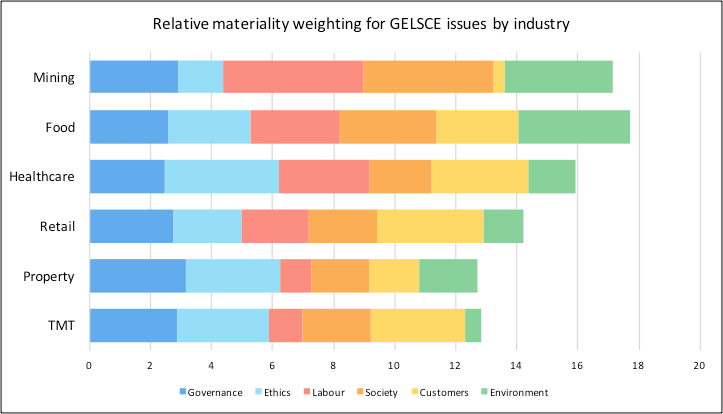

The stacked bar chart below shows how different the weightings for each issue category turn out across a sample of six industries. Labour, societal and environmental issues are most important for the mining sector, but least important for the retail, property and media sectors. Governance and ethics are most important for healthcare, property and media, while customer issues are most important for consumer facing industries, such as healthcare, retail and media.

Note also that some industries have higher overall materiality. This means the vulnerabilities and risks demanding leadership response are more pernicious, with more likelihood of failure should management not be able to deal with the challenges presented.

Step Three: Rate the company’s response to each issue

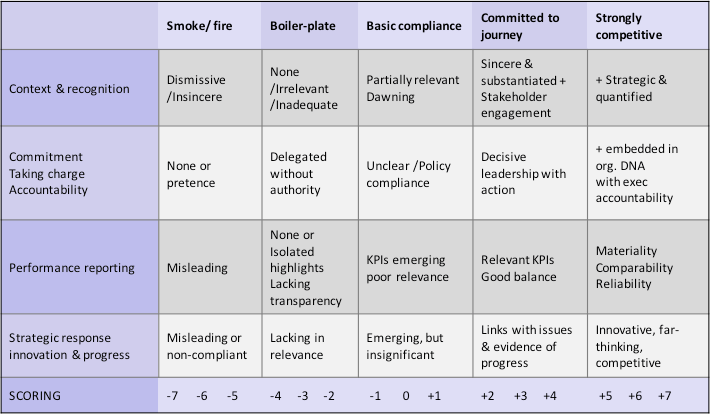

Each issue is rated for maturity of response from -7 to +7 across four aspects:

- Context – how well the company understands the issue

- Taking charge – how decisive, committed and accountable

- Reporting performance – use of indicators to monitor and report

- Responding strategically – how strategic, innovative and far-thinking the leadership response, and how well linked to the original issue context

The rubric below provides a high-level summary of FarSight’s assessment template. More detailed guidance is used for each specific issue and for each specific industry. Note that the range of scoring is both negative and positive. Negative scores show immature, value destructive behaviour, while positive scores show a mature response that indicates a leadership team building long-term value for the business and reducing the risk of failure.

FarSight’s scoring rubric for assessing maturity of leadership response to issues

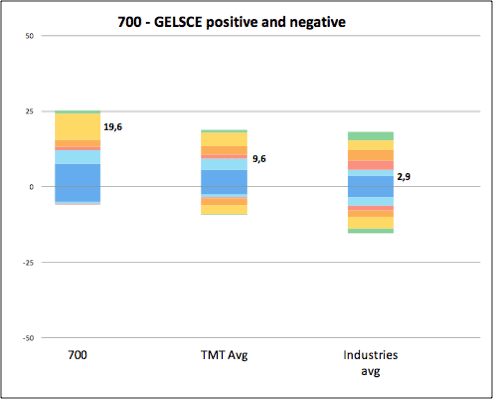

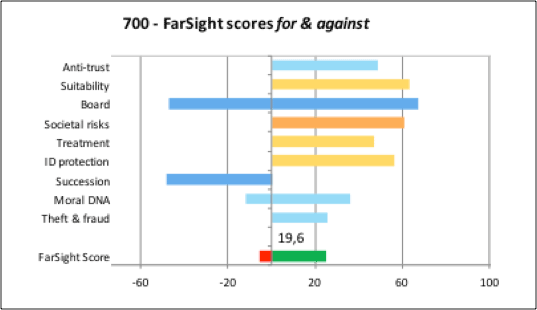

Step Four: Calculate the FarSight score

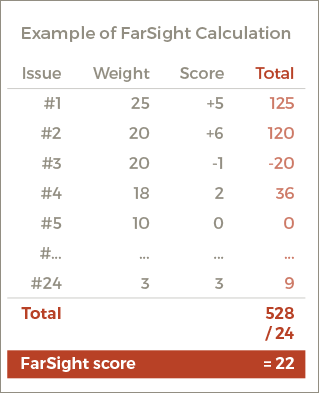

The company’s FarSight rating is the average of all its issue scores. The score for each issue is the mathematical product of its materiality weighting and its score for maturity of response. Thus, low materiality issues barely affect the score, while high materiality issues make up most of the score. The table below illustrates how the score is calculated and the relative contribution of high materiality vs. low materiality issues.

Interpreting FarSight scores

- A company that responds with a high level of maturity to its serious challenges/ threats/ risks/ vulnerabilities will achieve a high FS score

- A company that responds immaturely to its serious challenges/ threats/ risks/ vulnerabilities will get a poor FS score, regardless of how well it responds to issues not relevant to the business

- A leadership team that presents clearly the importance of the issue and has a strategy in place to deal with the issue, backed up by well-defined milestones for achieving performance targets, would indicate a strong leadership culture. Such a leadership team could be relied upon to make responsible decisions and take real action to secure value generation into the future, not only for issues of concern to society, but also for traditional financial and operational issues.

- At the other extreme, a company that dismisses an issue as being less material (than assigned by FarSight), and then puts out misleading information about its performance (e.g. window-dressing), would score negatively, thus contributing to an assessment of an ineffectual leadership team that cannot be trusted to identify material issues well ahead of time and deal with them strategically and effectively.

Clearing up misconceptions

FarSight does not penalise companies for being in so-called ‘sin industries’, rather we judge how responsibly the company responds to the vulnerabilities and risks of being in that industry

FarSight scores cannot be ‘gamed’ by ticking the box with boilerplate policies and basic compliance. Positive scores can only be gained by sincere, decisive, measurable action

FarSight aims not to be fooled by virtue signalling – the stiffest penalties (negative scoring) are assigned to insincere and misleading pronouncements and reporting

The FarSight score is not a measurement of company impact on society/ environment, rather it is a measure of how responsibly the company responds to its challenges in the interests of its shareholders

FarSight does not form an opinion based on indicators of past performance, rather, it looks for leading indicators of future performance. The FarSight score is itself an indicator of the strengths of the company’s resources and relationships that, with good strategy, will take the company forward

FarSight’s assessment model is not not an arbitrary home brew, It applies internationally accepted ESG criteria (engagement, materiality, reliability, transparency, accountability, etc.), in turn based on financial accounting standard

How is FarSight different?

By measuring maturity of response, rather than policies and impacts, FarSight solves the problem that has long faced the ESG industry, namely that there is a poor correlation between ESG impact and operational and financial (and thus investment) risk. Realistically, policy response achieves no more than ticking boxes. Thus, traditional ratings score companies in ‘dirty’ industries facing serious challenges poorly, often in sharp contrast to the investment case. Such analysis discourages companies from taking on environmental or social risk.

FarSight, by contrast, will score a company highly if an excellent leadership team acquires a dirty, poorly run company and sets about addressing its challenges. A high FarSight score would thus indicate a mature management better able to take on the risk responsibly and unlock value.

What is leadership maturity?

Mature leadership, achieving high FarSight scores, are more likely to:

- Look further ahead and foresee:

o potential shifts in market dynamics

o threats from emerging legislation

o societal concerns raised by their customers and other business partners

o opportunities to innovate or position the company ahead of competitors - convert potential threats to the industry into opportunities to win margin/market share, or save costs through efficiencies/increased productivity

- reap the benefits of a more reliable, engaged and fulfilled workforce

- build companies with sustained-ability to return profits over the long term

Guidance for the securities analyst

This analysis serves a number of purposes:

- a measure of the quality of a company’s leadership

- a guide to non-financial issues emerging now, that may have an impact on the value creation ability of a company in a three- to five-year window

- a list of key issues when engaging with company management, or when delivering opinions around proxy voting

- a more valid application of ESG analysis than standard models that measure impact only, such as emissions, CSI spend, etc.

By applying this analysis, asset managers can exploit the integrated reporting industry’s newly adopted approach to the concept of responsible business. This recognises that by taking into account the interests of society only where relevant to business, and responding with effective business strategies to these challenges, the company is better placed to serve the long-term interests of its shareholders.

Academic support for the model

Confirming FarSight’s model rationale, a Harvard Business School Working Paper, published in March 2015, by Khan, Serafeim and Yoon, found that “firms with good performance on material sustainability issues significantly outperform firms with poor performance on these issues, suggesting that investments in sustainability issues are shareholder-value enhancing.” Further, it was found that “firms that spent more on immaterial sustainability issues, performed worse in this study.”

See here the industries and companies under FarSight’s coverage.